pipschain.online Learn

Learn

Auto Loan Installment Or Revolving

:max_bytes(150000):strip_icc()/Differences-between-revolving-credit-and-installment-credit_sketch_final-ccac21e2a4a94aeb90443ea2b92ec759.png)

Having both installment loans and revolving credit will help your credit score, as long as you pay the bills on time. Both types of credit illustrate to lenders. Unlike revolving credit terms, installments remain unchanged, unless one of the variables used to calculate them is altered. As a result, borrowers know exactly. Unlike installment credit, a revolving credit account remains open indefinitely. As long as you make your minimum payments and don't exceed your credit limit. Installment Loans. When you're looking for the simplicity of making fixed Auto Loans. Whether it's time to purchase a new family car or truck, or you. Credit cards and credit lines are examples of revolving credit. Examples of installment loans include mortgages, auto loans, student loans, and personal loans. Apply for a Personal Line of Credit, Personal Installment Loan, or Auto Loan A Personal Line of Credit is an unsecured, variable rate revolving loan. With each payment installment that you make, your balance decreases, and at the end of the 63 months your loan is paid off. In addition to auto loans. FICO gives precedence to installment loans over revolving credit, so it's doubly important to consistently pay your auto loan on time. By doing so, you'll. For starters, installment loans come in one lump sum, but revolving credit can be accessed multiple times as long as the balance is paid off or down. Payment. Having both installment loans and revolving credit will help your credit score, as long as you pay the bills on time. Both types of credit illustrate to lenders. Unlike revolving credit terms, installments remain unchanged, unless one of the variables used to calculate them is altered. As a result, borrowers know exactly. Unlike installment credit, a revolving credit account remains open indefinitely. As long as you make your minimum payments and don't exceed your credit limit. Installment Loans. When you're looking for the simplicity of making fixed Auto Loans. Whether it's time to purchase a new family car or truck, or you. Credit cards and credit lines are examples of revolving credit. Examples of installment loans include mortgages, auto loans, student loans, and personal loans. Apply for a Personal Line of Credit, Personal Installment Loan, or Auto Loan A Personal Line of Credit is an unsecured, variable rate revolving loan. With each payment installment that you make, your balance decreases, and at the end of the 63 months your loan is paid off. In addition to auto loans. FICO gives precedence to installment loans over revolving credit, so it's doubly important to consistently pay your auto loan on time. By doing so, you'll. For starters, installment loans come in one lump sum, but revolving credit can be accessed multiple times as long as the balance is paid off or down. Payment.

The two main types of credit are installment credit and revolving credit. Auto loans are classified as installment credit, whereas personal credit cards, for. Revolving credit is something like a credit card. You use borrow a portion of the money, then pay it back, and do so over and over. Types of Credit Accounts: This deals with whether you can manage both installment accounts (car loans, personal loans, mortgage) as well as revolving accounts . Paying down installment loans is a good sign that you're able and willing to manage and repay debt. Revolving Credit: The most popular type of revolving credit. Having both installment loans and revolving credit will help your credit score, as long as you pay the bills on time. Both types of credit illustrate to lenders. Auto loan Installment Loans vs Revolving Credit. I. Auto loan Secured vs Unsecured Debt. CBE. Auto loan Variable vs Fixed Rate. CBE, though fixed is far more. Credit cards are a common example of revolving credit. Your balances and payments change from month to month. Car loans are installment accounts. They're issued. Revolving loans include credit cards and home equity loans. Installment loans include student loans, mortgages and auto loans. In most cases, it's not. Because you'll have additional installment credit to complement your revolving credit, lenders will be much more impressed by your credit history. In. Installment credit includes items such as auto loans and home mortgages. With installment credit you sign a contract stating you will pay back the amount. It includes everything from car loans and mortgages to personal loans and student loans. When you take out an installment loan, you're agreeing to pay a set. The two main types of credit are installment credit and revolving credit. Auto loans are classified as installment credit, whereas personal credit cards, for. It includes everything from car loans and mortgages to personal loans and student loans. When you take out an installment loan, you're agreeing to pay a set. Credit cards are a common example of revolving credit. Your balances and payments change from month to month. Car loans are installment accounts. They're issued. Answer: Paying down installment loans will help your credit score, but typically not as dramatically as paying down balances on revolving debt such as credit. There are several types of installment credit, including auto loans, student loans, mortgages, and personal loans. When you are approved for one of these loans. Installment loans usually have a fixed rate, meaning the interest rate is set at the beginning and doesn't change over the length of the loan. The borrower. When it comes to financing significant expenses, installment loans can be a good option. Whether you're planning to buy a car, renovate your home. Auto loans can be either installment or revolving. Installment loans require fixed monthly payments over a set period until the loan is fully. When considering buying a new or used car, most of us take advantage of some form of auto financing. A car loan is a convenient way to get the car you need.

How To Get Free Money On Your Paypal

Get % APY⁷ with your PayPal Savings account. It's free to set up, FDIC insured with Synchrony Bank–and you can roll in all the cash back. Go to Wallet. · Click Transfer Money. · Click Withdraw from PayPal to your bank account. · Select Instant (Free) or Standard (Free). · Follow the instructions. 1. Participate in online surveys or paid research studies that offer PayPal gift cards as a reward. There are various websites and apps that. Lift receiving limits. PayPal can limit accounts that experience a sudden influx of money. · Upgrade your PayPal account. Upgrade to a Premier or Business PayPal. HOW TO REQUEST PAYMENTS TO YOUR PAYPAL ACCOUNT · Sign up for free at pipschain.online · Take part in online surveys to earn points and cash. · Earn a minimum of. PayPal is a smart and secure way to shop in-store and online, earn cash back on brands you love, send money to friends and much more. Get started in the app. If it's in your category, check out online with PayPal and use your PayPal Debit Card to add 5% cash back on top Learn More About Rewards. Go to Wallet. Click Transfer Money. Click Transfer to your bank. Select in minutes. Follow the instructions. Here's how to make. 24 Proven Ways to Earn Free PayPal Money in Your Complete Guide · 1. Take Online Surveys · 2. Participate in Cashback Programs · 3. Use. Get % APY⁷ with your PayPal Savings account. It's free to set up, FDIC insured with Synchrony Bank–and you can roll in all the cash back. Go to Wallet. · Click Transfer Money. · Click Withdraw from PayPal to your bank account. · Select Instant (Free) or Standard (Free). · Follow the instructions. 1. Participate in online surveys or paid research studies that offer PayPal gift cards as a reward. There are various websites and apps that. Lift receiving limits. PayPal can limit accounts that experience a sudden influx of money. · Upgrade your PayPal account. Upgrade to a Premier or Business PayPal. HOW TO REQUEST PAYMENTS TO YOUR PAYPAL ACCOUNT · Sign up for free at pipschain.online · Take part in online surveys to earn points and cash. · Earn a minimum of. PayPal is a smart and secure way to shop in-store and online, earn cash back on brands you love, send money to friends and much more. Get started in the app. If it's in your category, check out online with PayPal and use your PayPal Debit Card to add 5% cash back on top Learn More About Rewards. Go to Wallet. Click Transfer Money. Click Transfer to your bank. Select in minutes. Follow the instructions. Here's how to make. 24 Proven Ways to Earn Free PayPal Money in Your Complete Guide · 1. Take Online Surveys · 2. Participate in Cashback Programs · 3. Use.

Shopkick is another fun way to get free money on PayPal. They pay you for shopping but also offer small payments for things like walking into a specific store. InboxDollars. If you're looking for another platform to earn PayPal money, check out InboxDollars. Accessible as both a user-friendly website and mobile app. There are many websites that allow you to play games and receive your paypal free $5 dollars email. You can play games such as trivia, puzzle, arcade, etc. and. You can withdraw this money and deposit from your PayPal balance and deposit the sum into your bank account. This process takes between 2–3 business days. Earn up to £20 with today's must-have apps. Sign up and choose PayPal as your payment method in up to 4 of these select apps below. Or just link your account. How do you add money to your Card? Use the no-cost1 Direct Deposit service and you could have access to your funds up to 2 days faster2 than what traditional. Friends and Family payments can be made to anyone in the U.S. for free (from your bank account or PayPal). If you are sending money internationally, you may be. Split a bill. Collect rent from your roomies. Get paid back for dinner. Then get instant access to the money as soon as it hits your PayPal balance If you're receiving a PayPal deposit from Swagbucks, you'll first get a confirmation email. The minimum withdrawal amount to cash out a PayPal reward from. Option 1. Add money from your linked USD bank account · 1. Log into PayPal and look for the Wallet option · 2. Select Transfer money then Add money to your. 1. Sign up for a % Free Account! · 2. Earn points by completing short opinion surveys or easy offers. · 3. Redeem for Paypal Cash. Wondering how to save money while earning interest? Open a PayPal Savings account to earn interest on savings, manage your savings, and more. Completing Surveys: By sharing your views on various subjects through surveys, you can earn coins that can be converted into PayPal money. · Playing Games. There are several legitimate ways to earn free PayPal money. Participating in online surveys is a popular option, as many market research. Wondering how to save money while earning interest? Open a PayPal Savings account to earn interest on savings, manage your savings, and more. Download Apps & Get Paid Every Day. One of our new favorite ways for getting free PayPal cash involves using Kashkick, a leading rewards platform. What's nice. Download Apps & Get Paid Every Day. One of our new favorite ways for getting free PayPal cash involves using Kashkick, a leading rewards platform. What's nice. First, you'll need to create a PayPal Cash or PayPal Cash Plus account. This is free, but it requires PayPal to verify some of your personal information to. Swagbucks is a popular rewards and cash-back site that offers a number of ways to earn free PayPal money, including answering surveys and getting rebates. Transfer funds quickly and securely with PayPal. Send money online to friends and family from your bank account or PayPal balance for free. Get started.

Apy Investment

Individual Subscribers will not be having any option for choice of investment or select Pension Funds. Documentation. • APY application form. • Self-Declaration. Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we. APY, meaning Annual Percentage Yield, is the rate of interest earned on a savings or investment account in one year, and it includes compound interest. Higher APY means your balance grows faster. How is APY different from interest? An interest rate is the amount of interest that is paid on an investment or a. APY is a standardized measure used to express the annualized rate of return earned on an investment or savings account. Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we. Calculate the Annual Percentage Yield (APY) or effective annual rate for an investment based on an annual interest rate and compounding frequency. How to use APY to compare investments. You can also use APY to compare investment alternatives. For example, you may have the opportunity to invest a larger. APY reflects the potential return on your investment, accounting for compounding interest. In general, earning a higher APY on your investments or savings. Individual Subscribers will not be having any option for choice of investment or select Pension Funds. Documentation. • APY application form. • Self-Declaration. Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we. APY, meaning Annual Percentage Yield, is the rate of interest earned on a savings or investment account in one year, and it includes compound interest. Higher APY means your balance grows faster. How is APY different from interest? An interest rate is the amount of interest that is paid on an investment or a. APY is a standardized measure used to express the annualized rate of return earned on an investment or savings account. Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we. Calculate the Annual Percentage Yield (APY) or effective annual rate for an investment based on an annual interest rate and compounding frequency. How to use APY to compare investments. You can also use APY to compare investment alternatives. For example, you may have the opportunity to invest a larger. APY reflects the potential return on your investment, accounting for compounding interest. In general, earning a higher APY on your investments or savings.

APY stands for annual percentage yield. It is a way to calculate interest earned on an investment that includes the effects of compound interest. Learn how an APY works, how APY is calculated, the difference between Whether the topic is about the psychology of money, investment strategies or. The contributions under APY are invested as per the investment guidelines prescribed by. PFRDA for Central Government / State Government / NPS-Lite /. Purchase investments, pay bills, and manage daily expenses. · UNINVESTED CASH IN YOUR SCHWAB BROKERAGE AND RETIREMENT ACCOUNTS % APY Earn interest and use. Annual percentage yield, or APY, refers to the rate of return you earn on an investment per year. While it is related to your interest rate, it's not quite the. APY interest cannot remain on deposit; periodic payout of interest is required. You should carefully consider the investment objectives, risks, and charges. APY, then the more quickly the money you deposit can grow. Recommended: Use the APY calculator below to see how much interest you can earn on your investments. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. Use the APY calculator to work out the total interest and annual compounded interest rate on your investment or savings. APY, or Annual Percentage Yield, is a measure used in banking to calculate the total interest earned on a savings account or investment over a year, taking into. Annual percentage yield (APY) is similar to APR, but refers to money earned in a savings account or other investment, rather than the interest rate paid on a. Here's the definition of APY, and how it helps you understand your actual rate of return on your savings and investments. Calculate the Annual Percentage Yield (APY) or effective annual rate for an investment based on an annual interest rate and compounding frequency. APY or Annual Percentage Yield, is a metric used to express the annual rate of return on an investment, taking into account the effect of compounding. With the APY, you can calculate the yearly return of an investment with compounding interest, regardless of how frequently that interest is compounded. investment or loan. In other words, the interest rate of an account is just one component of the account's APY, which also factors in how often your. APY is an acronym used for annual percentage yield. APY, on compounding interest, is the rate earned on the pipschain.online the formula using solved. Annual percentage yield (APY) is similar to APR, but refers to money earned in a savings account or other investment, rather than the interest rate paid on a. Using APR and APY calculations to compare various investments and the real cost of a purchase requires that you understand what each of these terms mean, and. APY provides a more accurate measure of your return on investment. The APY is typically advertised by financial institutions more visibly, but interest.

Coinbase Card Fees

Coinbase Card charges a spending fee in two parts. First, you have the straightforward card commission. This commission is % for "domestic purchases". Your Binance Visa Card comes completely free! Binance does not charge any processing or administrative fees. Binance Funding Wallet allows you to hold crypto. Coinbase Wallet Currency Conversion. % of. ATM withdrawal amount plus applicable. ATM withdrawal fees. This fee is per transaction and is determined and. Coinbase offers cards affiliated with your wallet service. when you spend money with your card online there is no fee. However, there is a hidden transaction. The Coinbase card is free. Associated costs. Fees are currently unknown. Click here for the latest information on fees. Open a Coinbase account. Coinbase · Main platform features: Easy to use for beginners and allows the use of PayPal for withdrawing or selling · Fees: % to % per trade for “Makers. It's can be used for both cash and crypto transactions. There's no application fee or credit check during the application process. Learn more about Coinbase. Generally, there is a flat fee of % for buying and selling cryptocurrencies on Coinbase, with additional fees for credit/debit card. Fees for Coinbase retail market orders can be as high as %. Instead, place a limit order at the price you'd like to sell. Your fee will drop. Coinbase Card charges a spending fee in two parts. First, you have the straightforward card commission. This commission is % for "domestic purchases". Your Binance Visa Card comes completely free! Binance does not charge any processing or administrative fees. Binance Funding Wallet allows you to hold crypto. Coinbase Wallet Currency Conversion. % of. ATM withdrawal amount plus applicable. ATM withdrawal fees. This fee is per transaction and is determined and. Coinbase offers cards affiliated with your wallet service. when you spend money with your card online there is no fee. However, there is a hidden transaction. The Coinbase card is free. Associated costs. Fees are currently unknown. Click here for the latest information on fees. Open a Coinbase account. Coinbase · Main platform features: Easy to use for beginners and allows the use of PayPal for withdrawing or selling · Fees: % to % per trade for “Makers. It's can be used for both cash and crypto transactions. There's no application fee or credit check during the application process. Learn more about Coinbase. Generally, there is a flat fee of % for buying and selling cryptocurrencies on Coinbase, with additional fees for credit/debit card. Fees for Coinbase retail market orders can be as high as %. Instead, place a limit order at the price you'd like to sell. Your fee will drop.

Track every eur| bitcoin · The easiest way to spend crypto worldwide · Instant transactions and payments · Track your spend through the app · Easily choose which. Investors pay additional fees for using credit cards. Coinbase charges maker fees ranging from % to % and taker fees ranging from % to %. This. While the card touts free spending in local currency and USDC, other cryptocurrencies impose a % transaction fee. For example, you'll pay transaction fees. The fees may vary depending on your location and the specific ATM you use. Generally, Coinbase charges a flat fee of 2% for ATM cash withdrawals. Additionally. You can withdraw cash from ATMs using your Coinbase Card with no fees from Coinbase; however, the ATM may charge a fee. Please consult your tax advisor to. The Coinbase Card links to a mobile app, developed in partnership with Apto Payments Inc (formerly known as Shift Payments), providing users with spending. Currently, the spending limit for the Coinbase debit card is $2, per day. The maximum ATM withdrawal is $1, per day. Is there any way to increase the. Track every eur| bitcoin · The easiest way to spend crypto worldwide · Instant transactions and payments · Track your spend through the app · Easily choose which. Currently, the spending limit for the Coinbase debit card is $2, per day. The maximum ATM withdrawal is $1, per day. Is there any way to increase the. For example, if you use a debit card, there may be a % fee. There may also be a % fee for using a Coinbase USD wallet, and a minimum fee. Coinbase fees. Transaction and trading costs on Coinbase range from % to % depending on the cryptocurrency, transaction size and payment method. When you place an order at the market price that gets filled immediately, you are considered a taker and will pay a fee between % and %. Generally, there is a flat fee of % for buying and selling cryptocurrencies on Coinbase, with additional fees for credit/debit card. % cryptocurrency liquidation fee on every transaction for most currencies. USDC is fee-free, but all other supported cryptocurrencies carry the fee. Fees. If you're sending funds to Coinbase from a bank account, there's a 1% commission. Buying and selling cryptocurrencies incur transaction fees of about %. Coinbase Fees by Payment Method ; US bank account, % ; Coinbase USD wallet, % ; Debit card, % ; Instant card withdrawal, Up to % of any transaction. If you spend a USDC token with your Coinbase card then there is no transaction fee. However, Coinbase charges a flat percent transaction fee on all. The Coinbase card can be set up to pay with any crypto in your account, however, paying with say, Bitcoin, will incur a % transaction fee. Coinbase Card is a Visa debit card developed by Coinbase. It enables the user to instantly spend and track its bitcoin, ethereum, litecoin and more. There is no issuance fee for the card; however, cryptocurrency conversion fees may apply⁴. Customers in the US can join the Coinbase Card waitlist here to.

Profit And Balance Sheet

Owning vs Performing: A balance sheet reports what a company owns at a specific date. An income statement reports how a company performed during a specific. The balance sheet reports an organization's assets (what is owned) and liabilities (what is owed). The net assets (also called equity, capital, retained. The balance sheet reports an organization's assets (what is owned) and liabilities (what is owed). The net assets (also called equity, capital, retained. The net assets (also called equity, capital, retained earnings, or fund balance) represent the sum of all annual surpluses or deficits. The balance sheet also. Gross profit: your sales minus your costs; General costs: building rent, software, office supplies, wages, utilities, and more; Earnings before tax: the money. The income statement illustrates the profitability of a company under accrual accounting rules. The balance sheet shows a company's assets, liabilities, and. The profit and loss (P&L) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. In financial accounting, a balance sheet (also known as statement of financial profit entity. Assets, liabilities and ownership equity are listed as of. Balance sheet vs. the P&L: The difference between the income statement and the balance sheet. With examples and infographic. Owning vs Performing: A balance sheet reports what a company owns at a specific date. An income statement reports how a company performed during a specific. The balance sheet reports an organization's assets (what is owned) and liabilities (what is owed). The net assets (also called equity, capital, retained. The balance sheet reports an organization's assets (what is owned) and liabilities (what is owed). The net assets (also called equity, capital, retained. The net assets (also called equity, capital, retained earnings, or fund balance) represent the sum of all annual surpluses or deficits. The balance sheet also. Gross profit: your sales minus your costs; General costs: building rent, software, office supplies, wages, utilities, and more; Earnings before tax: the money. The income statement illustrates the profitability of a company under accrual accounting rules. The balance sheet shows a company's assets, liabilities, and. The profit and loss (P&L) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. In financial accounting, a balance sheet (also known as statement of financial profit entity. Assets, liabilities and ownership equity are listed as of. Balance sheet vs. the P&L: The difference between the income statement and the balance sheet. With examples and infographic.

Whereas, the income statement reveals a company's financials over a period of time, more like a movie. With a series of snapshots, however, balance sheets can. The balance sheet is one of the four most common financial statements produced by nonprofits and for-profits alike. The balance sheet is a snapshot containing. The Profit and Loss meant to compute the profit earned or loss suffered, the Balance Sheet aims to provide an overview of what the assets, liabilities and. Also known as a profit and loss statement (P&L), the income statement records a business's income and expenses over a specific reporting period, typically a. To prepare a balance sheet, you need to calculate net income. Net income is the final calculation included on the income statement, showing how much profit or. The P&L statement is one of the three most important financial statements for business owners, along with the balance sheet and the cash flow statement (or. What is Profit and Loss Account? ; Balance Sheet is a statement, P & L Account is an account ; State of accounts ; Accounts added in balance sheet maintain their. The relationship between balance sheets and profit and loss accounts. Guide. The profit and loss (P&L) account summarises a business' trading transactions -. There are three financial statements that work together to create a complete picture of your business's finances: the income statement, balance sheet, and cash. The income statement illustrates the profitability of a company under accrual accounting rules. The balance sheet shows a company's assets, liabilities, and. The basic formula for the balance sheet is: Assets = Liabilities + Shareholders' (or Owner's) Equity. Because the balance sheet is more detailed then the P&L. A profit and loss statement (P&L), or income statement or statement of operations, is a financial report that provides a summary of a company's revenues. This sample balance sheet from Accounting Coach shows the line items reported, the layout of the document and how it differs from an income statement. A balance sheet is usually prepared at the end of a year or on the last day of the accounting year while the profit and loss statement is created by accountants. Balance sheets are broadly prepared compared to profit and loss statements. A balance sheet shows what a company owes, its long-term investments and its assets. This comprehensive guide will shed light on net income on a balance sheet and explain how to calculate it. The balance sheet shows your company's assets, liabilities, and equity – basically the financial health of the business at a specific point in time. It is the top line of the company and represents the total income generated during a specific period. It is divided further into operating revenue or revenue. The income statement shows a company's revenues, expenses and profitability over a specific period, usually a month, a quarter or a year. Does the balance sheet. The balance sheet provides information on a company's resources (assets) and its sources of capital (equity and liabilities/debt).

How To Buy A Tld

Register pipschain.online for $ This New gTLD is perfect if you're the best in your business, work as a solo entrepreneur or offer daily discounts websites. To get your own TLD, you need to submit a completed, detailed application and fee (likely around $, or less) to ICANN. Companies can apply for their own top-level domain (TLD) name extension through the Internet Corporation for Assigned Names and Numbers (ICANN). TLD. Domain registrations We provide a large selection of top-level domains (TLDs) for you to register and manage at our domain registration service. Register popular domains pipschain.online pipschain.online, pipschain.online pipschain.online, or an international ccTLD. Whatever your needs, we've got a domain that fits you. Ready to buy a domain name? Fortunately, it's usually a straightforward process. Two of my favorite domain registrars are Bluehost and Namecheap. Both sites are. Register a gTLD with Namecheap. Every domain comes with free Whois Protection, Email & URL forwarding, free dynamic DNS & more. Order today! if you start your own registry, however that costs a $, non-refundable application fee, then if you get accepted, ICANN will also charge. Create your Top-Level Web3 Domain or Web3 TLD. Learn how to easily register your Top-Level Web3 Domain. Decentralized Web3 TLDs powered by Decentraweb. Register pipschain.online for $ This New gTLD is perfect if you're the best in your business, work as a solo entrepreneur or offer daily discounts websites. To get your own TLD, you need to submit a completed, detailed application and fee (likely around $, or less) to ICANN. Companies can apply for their own top-level domain (TLD) name extension through the Internet Corporation for Assigned Names and Numbers (ICANN). TLD. Domain registrations We provide a large selection of top-level domains (TLDs) for you to register and manage at our domain registration service. Register popular domains pipschain.online pipschain.online, pipschain.online pipschain.online, or an international ccTLD. Whatever your needs, we've got a domain that fits you. Ready to buy a domain name? Fortunately, it's usually a straightforward process. Two of my favorite domain registrars are Bluehost and Namecheap. Both sites are. Register a gTLD with Namecheap. Every domain comes with free Whois Protection, Email & URL forwarding, free dynamic DNS & more. Order today! if you start your own registry, however that costs a $, non-refundable application fee, then if you get accepted, ICANN will also charge. Create your Top-Level Web3 Domain or Web3 TLD. Learn how to easily register your Top-Level Web3 Domain. Decentralized Web3 TLDs powered by Decentraweb.

Why pipschain.online created? Who is it for? pipschain.online domain address was launched to help e-commerce websites stand out online. It is now the world's leading domain. TLD registries have assigned special or premium prices to some domain names. You can't use Route 53 to register a domain that has a special or premium price. Companies can apply for their own top-level domain (TLD) name extension through the Internet Corporation for Assigned Names and Numbers (ICANN). Register a gTLD with Namecheap. Every domain comes with free Whois Protection, Email & URL forwarding, free dynamic DNS & more. Order today! Choose from + Top Level Domains. Find your perfect TLD. Register popular domains pipschain.online pipschain.online, pipschain.online pipschain.online, or an international ccTLD. Domain Registration: Top Level Domains (TLDs). Step 1: Select the domain name that you want to buy · From your Shopify admin, go to Settings > Domains. · Click Buy new domain. · Enter the domain name that. In order to register a domain name with the Internet Corporation for Assigned Names and Numbers (ICANN), you must do so through a registrar, such as pipschain.online Namebase is a secure and easy platform to interact with Handshake, a decentralized internet blockchain DNS for the decentralized web. Buy, sell, and manage. Brand TLDs are assigned by an independent global organisation called the Internet Corporation for Assigned Names and Numbers (ICANN). You can't apply for a. Domain Registration: Top Level Domains (TLDs). Find out if you're eligible for pipschain.online domain. Learn how to get pipschain.online domain. Get tips for moving pipschain.online from another top-level domain. Buying a domain name with Bluehost is a breeze! You can search for your desired domain name above and purchase it within minutes. Our user-friendly interface. Register pipschain.online domain name. Includes URL forwarding, email, reliable BasicDNS, and 24/7 support - all for FREE! pipschain.online TLDs for sale today. Get your mission online with a trustable domain. Domain Transfer. Move your domain name to IONOS. Secure site traffic and build trust. Domain Security. Steps to buying a domain name · 1. Choose a reliable domain registrar · 2. Find a domain availability checker tool · 3. Choose the best domain name option · 4. Searching for and purchasing domain · Go to Emails and domains > Website and landing page domains. · Click on the Buy domain button. · Type the domain you want. There are a few ways to get a custom top-level domain name. You can buy one from a domain name registrar, or you can apply for one from ICANN. Compare the prices of domain extensions from 54 registrars. Check domain availability, discover free features, and find the best domain registrar. Domain Extension, Renewal Price per year after. Introductory Rate*, Register via. Front-of-Site ;.biz, $, ✓ ;.club, $, ✓ ;.co, $, ✓.

Pnfp Stock

Discover historical prices for PNFP stock on Yahoo Finance. View daily, weekly or monthly format back to when Pinnacle Financial Partners, Inc. stock was issued. In depth view into PNFP (Pinnacle Financial Partners) stock including the latest price, news, dividend history, earnings information and financials. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change (PNFP) is a financial holding company headquartered in Nashville, Tennessee. Through its wholly-owned subsidiary, Pinnacle Bank, the company offers a. Stock Price, News, Quote and Profile of PINNACLE FINANCIAL PARTNERS(NASDAQ:PNFP) stock. General stock ratings, overview and activity description. Is Pinnacle Financial Partners, Inc. (PNFP) a good dividend stock? Pinnacle Financial Partners, Inc. has a dividend yield of %. In order to be considered a. The average price target for Pinnacle Financial Partners is $ This is based on 10 Wall Streets Analysts month price targets, issued in the past 3. Track Pinnacle Financial Partners Inc. (PNFP) Stock Price, Quote, latest community messages, chart, news and other stock related information. View Pinnacle Financial Partners, Inc. PNFP stock quote prices, financial information, real-time forecasts, and company news from CNN. Discover historical prices for PNFP stock on Yahoo Finance. View daily, weekly or monthly format back to when Pinnacle Financial Partners, Inc. stock was issued. In depth view into PNFP (Pinnacle Financial Partners) stock including the latest price, news, dividend history, earnings information and financials. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change (PNFP) is a financial holding company headquartered in Nashville, Tennessee. Through its wholly-owned subsidiary, Pinnacle Bank, the company offers a. Stock Price, News, Quote and Profile of PINNACLE FINANCIAL PARTNERS(NASDAQ:PNFP) stock. General stock ratings, overview and activity description. Is Pinnacle Financial Partners, Inc. (PNFP) a good dividend stock? Pinnacle Financial Partners, Inc. has a dividend yield of %. In order to be considered a. The average price target for Pinnacle Financial Partners is $ This is based on 10 Wall Streets Analysts month price targets, issued in the past 3. Track Pinnacle Financial Partners Inc. (PNFP) Stock Price, Quote, latest community messages, chart, news and other stock related information. View Pinnacle Financial Partners, Inc. PNFP stock quote prices, financial information, real-time forecasts, and company news from CNN.

Research Pinnacle Financial Partners' (Nasdaq:PNFP) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth. Complete Pinnacle Financial Partners Inc. stock information by Barron's. View real-time PNFP stock price and news, along with industry-best analysis. Get the latest Pinnacle Financial Partners Inc. (PNFP) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Pinnacle Financial Partners Inc stock price (PNFP). Buying or selling a stock that's not traded in your local currency? Don't let the currency conversion. Discover real-time Pinnacle Financial Partners, Inc. Common Stock (PNFP) stock prices, quotes, historical data, news, and Insights for informed trading and. The latest Pinnacle Financial Partners stock prices, stock quotes, news, and PNFP history to help you invest and trade smarter. On average, analysts forecast that PNFP's EPS will be $ for , with the lowest EPS forecast at $, and the highest EPS forecast at $ On average. Pinnacle Financial Partners, Inc. is a bank holding company, which engages in the provision of financial solutions. It offers banking, investment, trust. Bank Shareholders. Created with Highstock NASD:PNFP Volume Jul Aug 70 0 2 k. XNAS:PNFP,NASD:PNFP historical stock data. Stock Date, Stock. Pinnacle Financial Partners stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. k. XNAS:PNFP,NASD:PNFP historical stock data. Stock Date, Stock Price. September 03, , $ August 30, , $ August 29, , $ August. The current price of PNFP is USD — it has decreased by −% in the past 24 hours. Watch Pinnacle Financial Partners, Inc. stock price performance more. Pinnacle Financial Partners (PNFP) has a Smart Score of 8 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom. View today's Pinnacle Financial Partners Inc stock price and latest PNFP news and analysis. Create real-time notifications to follow any changes in the live. According to 11 analysts, the average rating for PNFP stock is "Buy." The month stock price forecast is $, which is a decrease of % from the latest. Get the latest updates on Pinnacle Financial Partners, Inc. Common Stock (PNFP) after hours trades, after hours share volumes, and more. Stock analysis for Pinnacle Financial Partners Inc (PNFP:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and. View the real-time PNFP price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. View Pinnacle Financial Partners, Inc PNFP investment & stock information. Get the latest Pinnacle Financial Partners, Inc PNFP detailed stock quotes. See the latest Pinnacle Financial Partners Inc stock price (PNFP:XNAS), related news, valuation, dividends and more to help you make your investing.

What Is The Swift Code

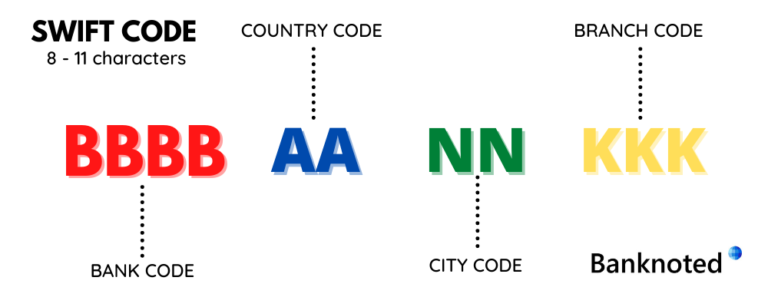

A SWIFT code is a standard format used when making international transfers between banks and financial institutions. It identifies the branch, bank, and country. What is a SWIFT Code? SWIFT codes are a type of Bank Identification Code (BIC) used for international wire transfers. These character long codes allow. SWIFT codes (also known as BIC codes) ensure safe and speedy international payments through the SWIFT system. When making an overseas transaction, a SWIFT code. Canadian Bank SWIFT Codes · RBC. RBC's SWIFT code is ROYCCAT2XXX. · BMO. Bank of Montreal's SWIFT code is BOFMCAM2XXX. · Scotiabank. Scotiabank's SWIFT code is. A SWIFT/BIC is an character code that identifies your country, city, bank, and branch. Bank code. The SWIFT code is a Business Identification Code (BIC) assigned to banks by SWIFT as an easy cross-border payment solution. For any transaction this bank makes. A SWIFT/BIC code consists of characters and follows a format that identifies your bank, country, location, and branch. What is a BIC code in banking? A Bank Identification Code, or BIC Code is an 8 to character code that is used to identify a specific bank when you make an. A SWIFT code (sometimes known as a SWIFT Number) are 8 to 11 characters long and made of both letters and numbers. You can typically find them on a bank. A SWIFT code is a standard format used when making international transfers between banks and financial institutions. It identifies the branch, bank, and country. What is a SWIFT Code? SWIFT codes are a type of Bank Identification Code (BIC) used for international wire transfers. These character long codes allow. SWIFT codes (also known as BIC codes) ensure safe and speedy international payments through the SWIFT system. When making an overseas transaction, a SWIFT code. Canadian Bank SWIFT Codes · RBC. RBC's SWIFT code is ROYCCAT2XXX. · BMO. Bank of Montreal's SWIFT code is BOFMCAM2XXX. · Scotiabank. Scotiabank's SWIFT code is. A SWIFT/BIC is an character code that identifies your country, city, bank, and branch. Bank code. The SWIFT code is a Business Identification Code (BIC) assigned to banks by SWIFT as an easy cross-border payment solution. For any transaction this bank makes. A SWIFT/BIC code consists of characters and follows a format that identifies your bank, country, location, and branch. What is a BIC code in banking? A Bank Identification Code, or BIC Code is an 8 to character code that is used to identify a specific bank when you make an. A SWIFT code (sometimes known as a SWIFT Number) are 8 to 11 characters long and made of both letters and numbers. You can typically find them on a bank.

To make it as simple as possible, banks typically provide the SWIFT code on your bank account statement near your account and routing numbers. If you need your. It's important to always verify your SWIFT code before sending money abroad. Enter a SWIFT / BIC code to our SWIFT code checker and find out to which bank. This article explains in detail the key differences between SWIFT codes and Sort codes, as well as when and how to properly use each. Simple way to find the right SWIFT/BIC code for your transaction. Find SWIFT/BIC code based on bank or country to find the right banks or branches. A SWIFT code (also called a BIC code) is an alphanumeric code used to identify specific banks in Canada and around the world. An important part of international. A SWIFT code is a code used to identify the country, bank and branch that an account is registered to. When you send money to a bank account overseas with. A SWIFT BIC code refers to a specific financial institution in an international transaction, whereas an IBAN number identifies an individual account and the. A SWIFT code is a number that identifies banks and other financial institutions around the world. The code is also called a Bank Identifier Code (BIC). How do I find the SWIFT/BIC code for my bank? You can find your bank's SWIFT code by looking it up on its website. For your foreign accounts on Grey, you can. A SWIFT/BIC code is used to verify the unique identity of a bank or financial institution—in turn making sure your money is sent to the correct place. An IBAN is used to identify an individual bank account involved in an international transaction while a SWIFT code is used to identify a specific bank during an. SWIFT is an acronym for the Society for Worldwide Interbank Financial Telecommunications. It may also be referred to as a BIC code (Bank Identifier Code). To find a SWIFT code, select your country, bank, and city using the form above. Alternatively, you can browse all SWIFT codes for a particular country. What does a SWIFT/BIC code look like? A SWIFT/BIC code is eight to eleven characters long. It can be used to identify the country, city, bank, and even specific. A SWIFT code is used to determine a particular bank, your IBAN identifies the individual bank account you're using for international bank transfers. It's easy to get started using Swift, with a concise-yet-expressive syntax and modern features you'll love. Swift code is safe by design and produces software. A SWIFT code is a term which defines a code used by a financial institution that is recognized universally. The code labels a certain financial institution. A SWIFT code (sometimes known as a SWIFT Number) are 8 to 11 characters long and made of both letters and numbers. You can typically find them on a bank. Follow the prompts for more details or review Additional Security Feature FAQs for more information. What is a SWIFT Code? A SWIFT code is a standard format for. A BIC code (or SWIFT code) is a unique code consisting of either 8 or 11 alphanumeric characters assigned to all banks and financial institutions.

How Much Does It Cost To Visit Harry Potter World

:max_bytes(150000):strip_icc()/diagon-alley-harry-potter-world-universal-VISITHARRY1217-de61267c612b47baab8bbb5dda100a15.jpg)

Based on average price of a 2-Park Universal Express Unlimited pass ranging between $ and $ 6Reservations required. Transportation schedule and. Hogsmeade is the Harry Potter theme park land to visit in Orlando if you're 4) How Many Days Do You Need for Harry Potter World? Plan to spend. The cost of admission will depend on the type of ticket you purchase. Single day tickets can range from $ – $ depending on the time of year and Express. Outstanding property for dog-travellers. Would do the Bungalows again, how many hotels have this much outdoor walking area? Reviewed on Dec 27, A family of four should budget approximately $2,+ for a two-day visit, covering park tickets, accommodations, meals, souvenirs, and miscellaneous expenses. At $53 per day with the 7-day pass, you'd literally be paying less than half the price of general admission tickets to Universal Studios Hollywood. The Starline. Explore The Wizarding World of Harry Potter™ at Universal Orlando. From Hogwarts™ castle to Gringotts™ bank, to flying through the Forbidden Forest on a. Book tours and tickets to experience Wizarding World of Harry Potter. Reserve a ticket for your trip to Orlando today. Free cancellation and payment options. The estimated cost of a visit to Harry Potter World is approximately $1, for four adults with 2-park-to-park tickets. This allows for a full day of. Based on average price of a 2-Park Universal Express Unlimited pass ranging between $ and $ 6Reservations required. Transportation schedule and. Hogsmeade is the Harry Potter theme park land to visit in Orlando if you're 4) How Many Days Do You Need for Harry Potter World? Plan to spend. The cost of admission will depend on the type of ticket you purchase. Single day tickets can range from $ – $ depending on the time of year and Express. Outstanding property for dog-travellers. Would do the Bungalows again, how many hotels have this much outdoor walking area? Reviewed on Dec 27, A family of four should budget approximately $2,+ for a two-day visit, covering park tickets, accommodations, meals, souvenirs, and miscellaneous expenses. At $53 per day with the 7-day pass, you'd literally be paying less than half the price of general admission tickets to Universal Studios Hollywood. The Starline. Explore The Wizarding World of Harry Potter™ at Universal Orlando. From Hogwarts™ castle to Gringotts™ bank, to flying through the Forbidden Forest on a. Book tours and tickets to experience Wizarding World of Harry Potter. Reserve a ticket for your trip to Orlando today. Free cancellation and payment options. The estimated cost of a visit to Harry Potter World is approximately $1, for four adults with 2-park-to-park tickets. This allows for a full day of.

Studio Tour London “The Making of Harry Potter. Tickets cost us £ for a family of four (thankfully smallest child is still free). As you know, we have been. The construction of both worlds took five years and cost million US dollars. The theme park includes attractions, restaurants, and shops themed around a. Universal Studios Japan Express Pass. If hanging out in Hogsmeade is likely to be the high point of your visit to USJ, I would also strongly recommend buying. Step inside the story on the streets of Diagon Alley™ where hidden dangers lurk far beneath Gringotts™ bank. Then, board the Hogwarts Express™ to travel to the. The tickets for General Admission is $ for family of 4 which is fine. I'm having trouble determining the cost after we're in. of The Wizarding World of Harry Potter™ with a Park-to-Park ticket. Save up to $20 off the gate price on multi-day tickets. Book your The Wizarding World of Harry Potter tickets online! Save time and money with our best price guarantee ▻ make the most of your visit to Los Angeles. Walt Disney World® Resort Theme Park Tickets. Activity duration is 1 day. 1d+. out of 10 with reviews. 8/ (2,). Price is $ per adult. The Making Of Harry Potter Logo · Contact Us. Close. Choose a Language. English How many people does a family ticket cover? A family ticket permits. At $53 per day with the 7-day pass, you'd literally be paying less than half the price of general admission tickets to Universal Studios Hollywood. The Starline. The tour costs £85/adult, £80/child (), £46/child () for transportation and entrance ticket. Tour runs daily with several departures per. Tips for Visiting Harry Potter World · While parking is easy and costs $30 for the day, I'd recommend staying near the park and walking instead. · Get there early. Universal Express: Prices start at $ per person per day for one park and $ for two parks and go up to almost double that amount. This pass lets you. Enter The Wizarding World of Harry Potter™ across two theme parks at Universal Orlando Resort and trade the Muggle world for endless magical adventures. Buy. Imagine getting 2 days free ride VelociCoaster or visit The Wizarding World of Harry Potter. First how many days did you want to visit Universal Orlando Parks. Find all ticket prices and the different ticket types available for the Studio Tour. Tickets must be booked in advance. Adult tickets start from £ That's an average value of $ per person, per day. (Valid theme park admission required; select attractions. Not valid at Universal Volcano Bay or. The Wizarding World of Harry Potter is a chain of themed areas at Universal Destinations & Experiences based on the Harry Potter media franchise. It's best if you visit the islands of adventure side (and if you're already at the main park, you need to pay 50 bucks to get to the other side). There are so many amazing things to see and do at the Wizarding World of Harry Potter, that it's vital to arrive early so that you have enough time to.

Obtaining Business Credit Without Personal Guarantee

With a personal guarantee, you're legally bound to cover the expenses in the event of a default. In this situation, the lender could seize your personal assets. This book is your key to accessing trade credit, business credit cards, and even business loans with just your EIN—no personal guarantee needed. The strategies. 1. Incorporate your business and obtain a federal tax ID number · 2. Complete corporate conformity · 3. Select business classification codes · 4. Set up a complete. Are interested in earning cash back, not rewards points. Prefer a no annual fee card. Are looking to manage business cash flow and want easy-access to credit. Other business credit cards with no personal guarantees typically require a business to be at least two years old with several million dollars in annual sales. That's just how people here apply for them. If you have a properly formed LLC or other legal business entity, then you can apply for business. Long story short you need to set up your duns and Bradstreet profile (business credit) and then get small accounts with suppliers or stores that. Can you get a business credit card with no credit check? The only business cards that truly require no credit check are corporate cards. These cards rely on. Generally, lenders will require a personal guarantee to obtain a business credit card. A personal guarantee gives the lender more confidence that they will be. With a personal guarantee, you're legally bound to cover the expenses in the event of a default. In this situation, the lender could seize your personal assets. This book is your key to accessing trade credit, business credit cards, and even business loans with just your EIN—no personal guarantee needed. The strategies. 1. Incorporate your business and obtain a federal tax ID number · 2. Complete corporate conformity · 3. Select business classification codes · 4. Set up a complete. Are interested in earning cash back, not rewards points. Prefer a no annual fee card. Are looking to manage business cash flow and want easy-access to credit. Other business credit cards with no personal guarantees typically require a business to be at least two years old with several million dollars in annual sales. That's just how people here apply for them. If you have a properly formed LLC or other legal business entity, then you can apply for business. Long story short you need to set up your duns and Bradstreet profile (business credit) and then get small accounts with suppliers or stores that. Can you get a business credit card with no credit check? The only business cards that truly require no credit check are corporate cards. These cards rely on. Generally, lenders will require a personal guarantee to obtain a business credit card. A personal guarantee gives the lender more confidence that they will be.

You can get a company credit card from a bank without any personal guarantee. All you need to have is what the banks ask: a dependable small business. Many small business credit cards are offered without a secured deposit, which is where a personal guarantee comes into play. applying for business credit cards without having to enter into any personal guarantees. As far as Dun and Bradstreet are concerned, it offers a "Paydex. Other business credit cards may not require a personal guarantee, but they may require the business to have a certain level of the creditworthiness or financial. Types of Business Financing That Don't Require a Personal Guarantee · Tier 1 Trade Credit · Corporate Credit Cards · Business Lines of Credit · Non-Recourse. 1. Pick a Business Name and Contact Information · 2. Form a Business Entity · 3. Obtain a Federal Employer Identification Number (EIN) · 4. Use Your Business to. Do I need to provide a personal guarantee for a Credit Line for business? If you are a sole proprietorship or a partnership, you will need to a sign a. How to Get a Business Credit Card without a Personal Guarantee If you are a small business looking to streamline your purchases and minimize cash advances. A personal guarantee is an agreement an owner or executive makes to pay back a debt if the business cannot. It acknowledges that you'll personally pay for. I know of no US credit card company that does not require a personal guarantee for a business credit card. They will decide whether or not to. Yes, some lenders allow you to avail small business loans without a personal guarantee. For the approval of the loan, they will look at your. Yes, some lenders allow you to avail small business loans without a personal guarantee. For the approval of the loan, they will look at your. The SVB Innovators Card is the best business credit card without a personal guarantee because it has a $0 annual fee, and allows you to add unlimited employee. This article will help you understand what's needed to get a credit line without a personal guarantee, and where you can get one with the best rates and terms. applying for business credit cards without having to enter into any personal guarantees. As far as Dun and Bradstreet are concerned, it offers a "Paydex. Brex Card · Overall best business credit card with no personal guarantee, no credit check, and flexible payment options ; Coast Fuel Card · Best for fuel expenses. Now that your business has established some business credit. You can apply for business credit cards without having to give a personal guarantee. Keep in. To some extent, your business and personal credit may remain linked, no matter how hard you work to keep them separate. For example, if you're applying for. A business credit card that requires no personal guarantee is a card that doesn't hold you personally liable if you can't pay off your debt. This could be. However, creditors are always going to ask. So what do you do? You will find that in order to obtain credit from anyone without a personal guarantee there is.